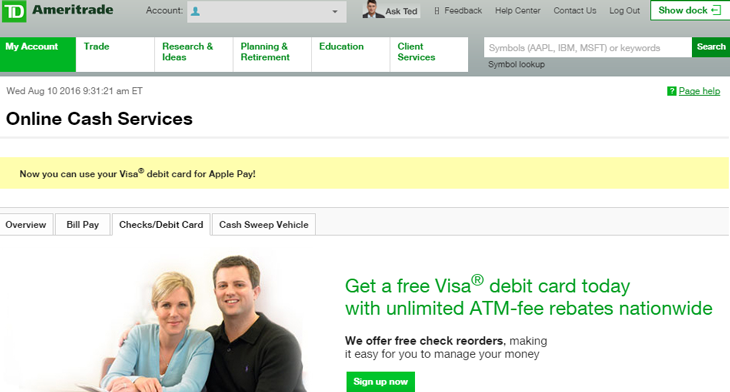

TD Ameritrade Checking Account Features

- No monthly maintenance fees, no minimum balance requirements

- Unlimited check writing and free standard 100 checks re-orders

- Free online bill pay

- Avoid ATM fees—you get reimbursed for any ATM charges nationwide

- Easily move money between TD Ameritrade accounts

- Cash earns 0.01% APY

- FDIC insured

TD Bank Brokerage Review

TD Bank not only offers banking services but also a brokerage called TD Ameritrade that comes

with a free checking account. TD Ameritrade is one of the largest online brokers in the Unites States,

truly a household name. It offers many financial products, including investing accounts,

most available IRAs, best crypto brokerage and banking products.

Account could be opened with $0 down.

Open TD Ameritrade Checking Account

$0 commissions + transfer fee reimbursement.

|

|

Firstrade Checking Account Features

- Firstrade customers can open a hybrid investment-cash management account

- $25,000 account balance required

- Checks and a free Visa debit card provided by UMB Bank

- No charge for these banking tools

- No annual fee for the account

- Stocks, ETFs and mutual funds can be traded in this account

- Lowest pricing on stock, ETFs and mutual funds trades

- No liability for unauthorized transactions

- No additional cost when you charge transportation tickets on a licensed common carrier to your Visa debit card

Firstrade Review

Firstrade is arguably the best priced online brokerage firm in the industry with $0 opening deposit. Their brokerage accounts come with a

lot of perks including the lowest investing cost, large selection of commission free funds, good research amenities, and easy to use tools.

For added convenience they also offer free check writing privileges.

Open Firstrade Checking Account

Get up to $4,000 cash bonus + $200 in ACAT rebate!

|

|

USAA Bank Checking Account Features

- Free 60,000 USAA-preferred ATMs. If customer uses another bank's ATM, USAA will refund their bank fee

- Clients can deposit checks from their smartphone or scanner

- Payment, management and monitoring bills in one place

- USAA fraud alerts notify clients of suspicious activity on their account

- Personal budgeting tool that helps customers track their spending

- Person-to-person payments allow users to send money from phone using a phone number or email address

- At least $250,000 FDIC insurance

USAA Bank Checking Review

USAA customers can choose between two checking account options: Secure Checking and Secure Checking Plus. Both accounts offer online bill pay,

money transfer from other banks with no charge, $0 liability on unauthorized charges, sending money through the smart phone.

Open USAA Checking Account

ATM Rebates. No monthly service Fees. USAA Classic Checking.

|

|

TD Bank Checking Overview

Toronto-Dominion Bank (TD Bank) bills itself as "America's Most Convenient Bank," a mantle it picked up when it acquired Commerce Bank in 2004. Opening its doors in New Jersey in 1973, Commerce pioneered the concept of a bank as retail store, staying open in the evenings and on weekends. TD Bank adopted the complete customer service playbook of its predecessor - right down to the free lollipops available at the teller counters. The only difference existing Commerce customers saw in their banking experience during the makeover was that Commerce's cherry lollipops were replaced by lime- and grape-flavored ones in TD Bank's colors.

After buying out Commerce, the Canadian-based TD Bank went on a shopping spree of American banks and now has 1,300 "stores" - as the company calls its banks - in every state on the Atlantic Seaboard, save Georgia. TD Bank ranks among the ten largest banks in the United States and each location maintains the longest banking hours in its market.

TD Bank Checking Accounts

True to its roots as the "people's bank" TD Bank works hard to present its checking account options as the most user-friendly for consumers. Unlike most other banks no minimum initial deposit is required to launch an account and if you pay just a modicum of attention to money management you will never encounter a fee as a checking account customer at TD Bank.

Basic Checking Accounts. The foundation personal checking account at TD Bank is called Convenience Checking. It sports a $15.00 monthly maintenance fee that is one of the industry's highest but is waived if your balance never drops below $100. For those who have a less firm grasp on their personal finances there is a Simple Checking account that enables everyday banking with no minimum balance requirement and a $5.99 maintenance fee every month.

Interest-Bearing Checking Accounts. The top-of-the-line checking experience at TD Bank is Premier Checking. A $2,500 minimum balance waives the $25.00 monthly fee and also returns ATM surcharges from machines outside the TD Bank universe. All ATM transactions are free with Premier Checking, regardless of balance. Other routine banking services such as money orders, bank checks, stop payments, paper statements and incoming wire transfers are all scored with no fees for Premiere Checking members. Interest earned is based on the amount of the account balance.

If you want to link your checking account with other TD Bank accounts you can qualify for all the goodies up for grabs with Premier Checking if the sum of all deposited money

exceeds $20,000 on a daily basis. Plus, you can get a discount on a safe deposit box if any are available at your retail location.

Age-Based Checking Accounts. Senior checking with interest at TD Bank starts at age 60. The monthly maintenance fee is $10 and the minimum daily balance is $250. You get some of the perks of the bank's gold-plated accounts such as safe deposit box discounts, free paper statements and free checks and money orders. Student checking can be had from the age of 18 until 24 with full-time school enrollment. There are no monthly maintenance fees nor minimum daily requirements. After age 24 the account automatically rolls over into a Convenience Checking plan.

Free, Free, and Almost Free

All TD Bank checking accounts are tethered to a long laundry list of "freebies." These include such standard-issue perks as direct deposit, a Visa-backed debit card, online and mobile banking and access to its 15-state ATM-network. All free, like many competitors. Some benefits at TD Bank that are less common include gift cards, both loadable and re-loadable, with no purchase fees and live customer service any time of the day or night any day of the week.

Commerce Bank was famous for its Penny Arcade automatic coin counting machines that were free to everyone. TD Bank kept the handy change counters as well but in 2010 most locations began restricting their use to bank customers only. Everyone else has to surrender a 6% usage fee.

Additional bank services can also be purchased and linked to your personal checking account such as overdraft protection ($35 fee per transaction that exceeds $5 and a one-time $20 sustained ding if the balance stays negative for more than ten days) and reward-generating credit cards. Checks can also be ordered at somewhat reduced rates. Deposits of less than $100 are available for withdrawal from your account immediately; sums over $100 must wait until the next day to be tapped.

TD Bank lays out all its checking plans with simple-to-navigate tables and explanations on its website. While there you can also view its tutorial videos on choosing the most effective checking account for your needs.

TD Bank Checking Online Experience

Log-in at TD bank online, free for any checking account, is by social security number and password; there are no further security hurdles. The session logs off automatically after a short period of inactivity. An ever-expanding menu of activities can be handled electronically. Transfers between internal TD Bank accounts and a widening array of external banks can be accomplished with a few clicks. Person-to-person payments are executed with Popmoney and you can also pay bills online. If you eliminate paper statements you can save a buck on maintenance fees and view balances at any time; you can also examine check images. Once signed up for online banking you can pick and choose how often you want to receive emails and alerts to your inbox from "America's Most Convenient Bank."

About USAA Bank

In 1922, when 25 Army officers met in San Antonio, Texas, and decided to insure each other's vehicles, they could not have imagined that their tiny organization would one

day serve over 8 million members and become one of the only fully integrated financial services companies in America.

USAA provides a full range of highly competitive financial products and services to the military and their families. And their world-class employees are personally

committed to delivering excellent service and great advice.

USAA membership is a privilege earned by those in uniform — and it's a privilege that can be handed down to their children. Membership is open to:

- Active, retired and honorably separated officers and enlisted personnel of the U.S. military.

- Officer candidates in commissioning programs (Academy, ROTC, OCS/OTS).

- Adult children of USAA members who have or had a USAA auto or property insurance policy.

- Widows, widowers and former spouses of USAA members who have or had a USAA auto or property insurance policy.

In addition, certain products, including investments, financial planning, life insurance and banking products — checking, savings, CDs and credit cards —

are available to the public.

USAA Mutual Funds Review

USAA is one of the investment firms which means that it offers clients their own family of mutual funds to invest in. The funds differ significantly in asset allocation,

expenses and performance. This year we compared them against each other and picked the best USAA mutual funds:

USAA Brokerage Review

Aside from banking services, USAA also offers an online investing to all its customers. With it clients could invest in stocks, ETFs

mutual funds, bonds, and even buy and sell options. The commissions on these investments are about average in the industry with two pricing plans

available: one for more active investors and the other for more traditional customers. A brokerage account is easy to set up and offers an additional

convenience to those who are already banking with USAA.

|