Overview of Ally Money Market Account

Ally Financial is an FDIC-insured online bank. Ally’s Money Market savings account sets itself apart from competitors with a high APY, minimal fees, customizable security features, and a well-designed online banking experience. Interest is compounded daily.

Minimum balance: $0

Monthly maintenance fees: $0

APY: 0.9% for balances less than $25,000. 1.00% for balances of $25,000 or more

Transaction limit: 6 per month, not including unlimited deposits and ATM withdrawals

Deposit limit: $50,000 per day

ATM Fees: $0 fees on Allpoint ATMs throughout the US. Ally will reimburse a maximum of $10 on ATM fees charged by other US financial institutions.

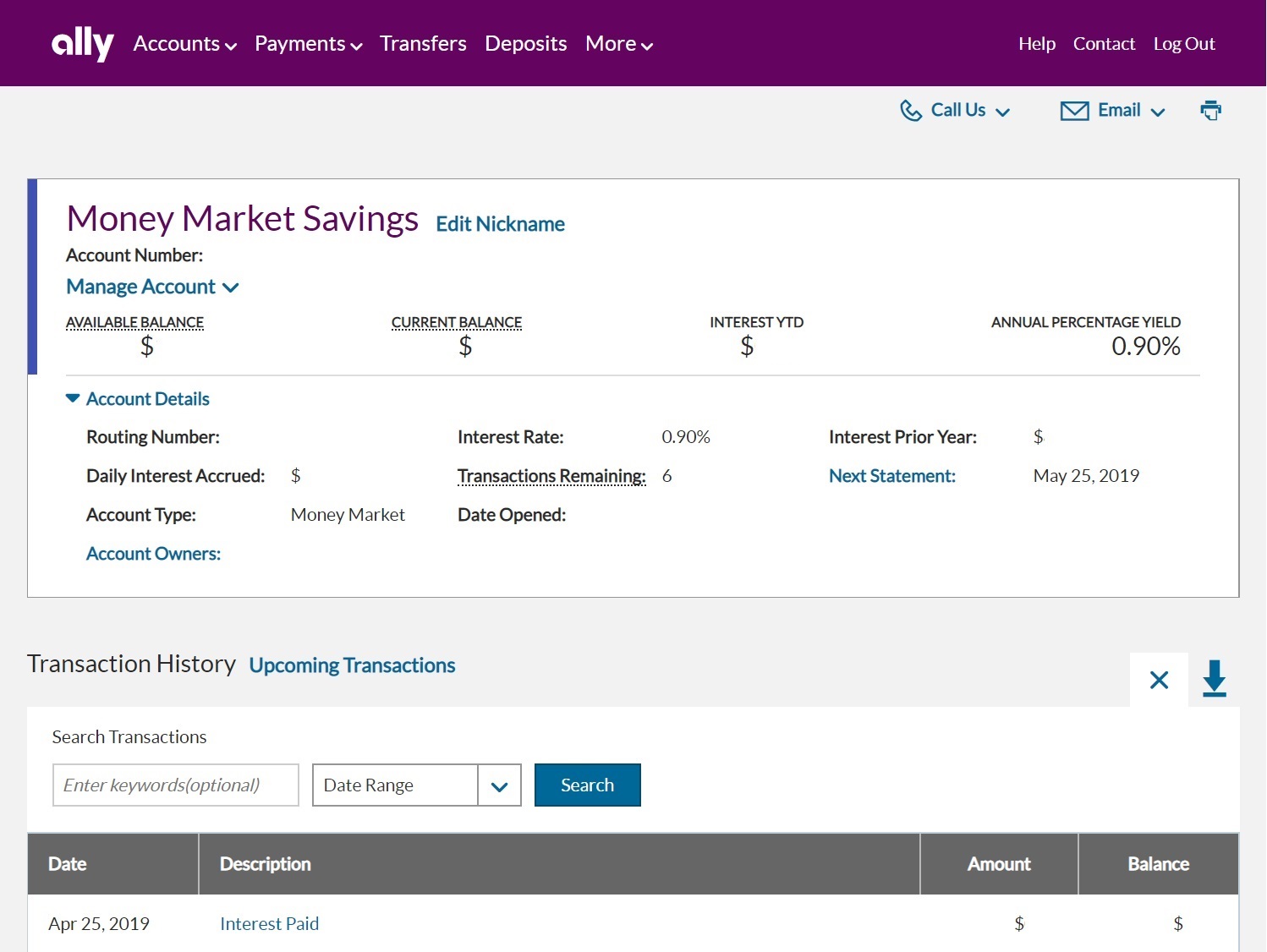

Account Snapshot

The Account Snapshot allows customers to easily track their account activity. They can view their remaining transactions, YTD interest and interest in the prior year, APY, and more. All account history is searchable by date and keyword.

Banking Online

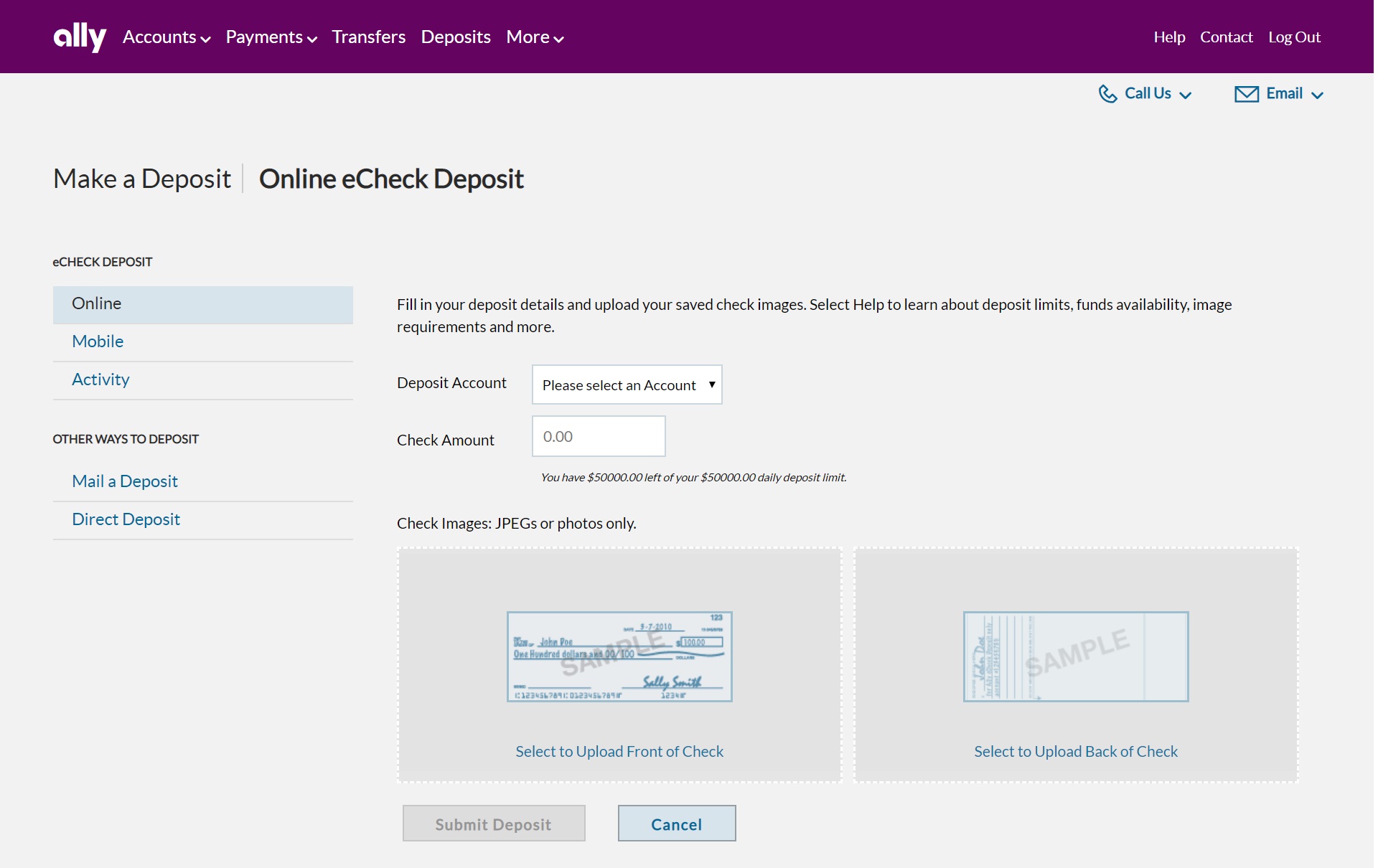

Ally is an online bank. Customers who have never banked online before may be hesitant to make the leap, but Ally’s customer service and eCheck deposit system make for a convenient and smooth transition to online banking.

Ally has 7am-10pm ET, 7 days a week customer service available for its banking customers. Ally customers and potential customers can call in at any time and speak directly to a representative.

Ally’s eCheck deposit allows customers to deposit checks using any mobile device or computer. On a computer, the customer can upload JPEG image files or photos of the front and back of their check. On a mobile device, the eCheck Deposit feature of Ally’s mobile app will guide customers through the deposit process, helping them take photos that will pass Ally’s quality standards. Once the check is deposited, customers will be notified via email. Customers can easily view their past deposit history online.

Occasionally, the photo of the check may not be clear enough. If this occurs, the customer will be notified via email, and they can retake the pictures with the app. This can be a minor inconvenience.

It’s important to note that eCheck deposit has limits. Customers cannot deposit more than $50,000 per day.

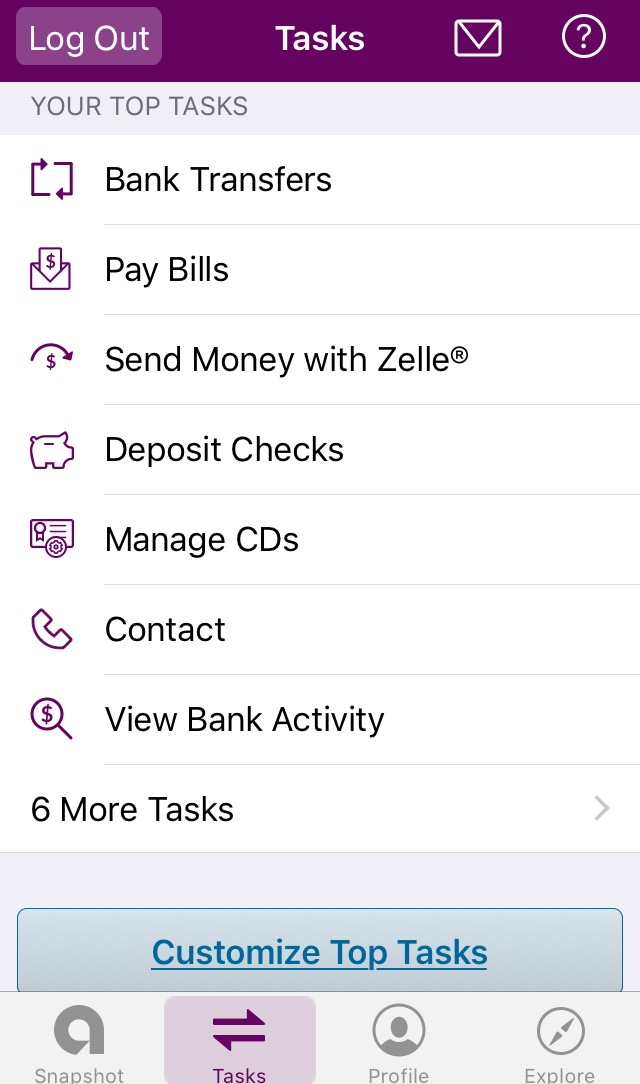

App

Ally’s banking app has a streamlined and intuitive design, and it offers a comprehensive array of features. Customers can easily find links to view their account activity and history, make transfers, pay bills, send money with Zelle, deposit checks using eCheck deposit, contact Ally customer support, locate nearby ATMs, set custom security alerts, change their account information, and view documents like bank statements and tax forms. Customers can conduct all of their banking through the app if they wish to.

Low Fees

With no maintenance fee or minimum balance, there is no barrier to entry for this high-interest account, Additionally, funds can be instantly transferred to an Ally checking account without any additional fee.

However, customers are limited to 6 Money Market Account transactions per month. This does not include deposits or ATM withdrawals, which are unlimited. Customers who exceed the transaction limit will be charged a $10 fee for each transaction over the limit.

Cash

One downside of online banking is that Ally customers cannot deposit cash directly into their account. However, they can deposit cash at a physical bank and then transfer it to their Ally account.

Transfers

Ally’s account-to-account transfer process is fast and convenient. Transfers between Ally Bank accounts are instant, and funds should be available immediately. Transfers between Ally Money Market accounts and accounts at other financial institutions take approximately three business days.

If needed, customers can request a next-business-day transfer to another financial institution. However, this feature is only offered to select Ally Bank customers in good standing, and will not be available to new accounts.

Security

Ally offers easily customizable security features for customers who want to increase the security level of their account: two-factor verification, a verbal password, and custom alerts.

Two-factor verification is the standard for Ally Money Market Account online login, but customers can opt out if they wish to. When using two-factor verification, customers will receive a one-time verification code via text message or email each time they log into their account.

Additionally, customers can set up custom email or text notifications to alert them of account activity. Customers can receive alerts for changes in their account balance, new deposits, or debit transactions. Any of these alerts can be customized for specific amounts: for example, an alert for any debit transaction over a certain dollar amount, or when the account drops below a certain dollar amount.

Finally, Ally allows customers to add a verbal password to their account to improve their account security when calling in to speak to a customer service representative.

How does Ally Money Market Savings Account compare to competitors?

Synchrony Bank, another online bank, offers a Money Market account with a 1.2% APY and no minimum balance. However, Synchrony does not offer 24/7 customer service.

Capital One 360 also offers a Money Market Account. They offer a whopping 2.00% APY for balances over $10,000. However, balances under $10,000 have a 0.85% APY. Capital One 360 does not offer 24/7 customer service for their online banking.

Who should use Ally’s Money Market Savings Account?

- Customers who want to earn a high interest rate on money but easily transfer it out of the account as needed

- Customers who enjoy the convenience of banking online or via a mobile app

- Customers who struggle to find time to go to the bank or talk to their bank’s customer service during normal business hours

Who shouldn’t use Ally’s Money Market Savings Account?

- Customers who want to be able to deposit cash to their savings account

- Customers who want to use their savings account to make more than 6 transactions per month (not including deposits or ATM transactions)

- Customers who want to deposit checks into their savings account quickly without any risk of delay

- Customers who want to have the ability to deposit checks for amounts over $50,000 directly into their money market account.

Ally Money Market Review Summary

In summary, Ally’s Money Market savings account offers a high interest rate and a convenient, well-designed online banking

experience. However, customers who want to deposit cash, make high-value transactions or make many transactions per month may feel

limited by this account.

|