|

Goldman Sachs Savings Account Review

Goldman Sachs savings account review 2024: bank fees, APR/APY interest rates, CDs high yields. Goldman Sachs service, cons, pros, deposits.

|

Goldman Sachs Bank Savings Overview

Goldman Sachs, the well-known Wall Street investment bank, has recently opened a Main Street bank that offers savings accounts and certificates of deposit. Let's take a detailed look at these deposit accounts and see how they compare to what other retail banks offer.

Opening a Goldman Sachs Savings Account

The account opening process is fairly straightforward. The on-line application asks for general information from the applicant. This includes name, address, and Social Security number. The firm pulls a credit report to verify the applicant's identity.

Conveniently, there is no initial deposit requirement to open an account. Signing account forms electronically is required, as is enrollment in electronic delivery of statements. Customers can add a beneficiary for each account. Up to six beneficiaries per account may be named.

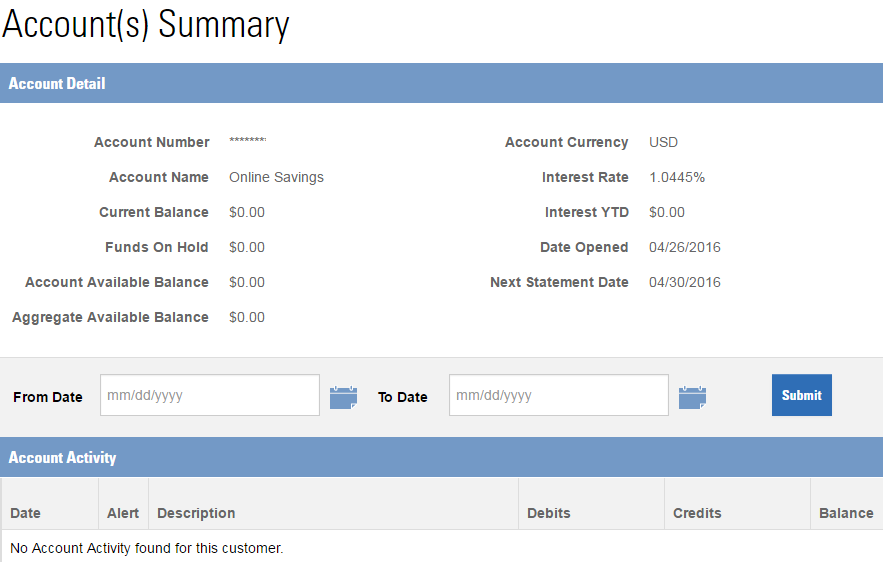

Once the application process is completed, the account is available on-line immediately. To gain access to the website, users must submit three challenge questions, which can be used later for identification purposes.

Goldman Sachs Savings Account

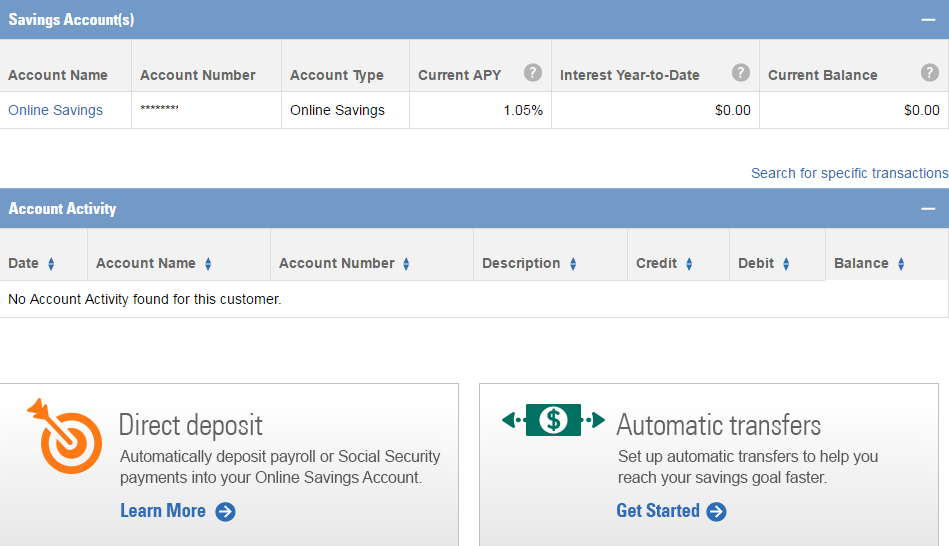

A savings account at Goldman Sachs Bank comes with no fees. There are no monthly fees, and no fees to deposit or withdraw. The savings account does not have checks or a debit card. Since the firm is FDIC insured, the first $250,000 is protected by the federal government. There is a limit of six withdrawals per month, the standard policy for savings accounts in the U.S.

Interest is compounded daily and paid monthly. Statements are calendar-month statements, meaning the closing date is the last day of each month. The current APY is 1.05%. There is a minimum balance of $1 to earn interest.

The bank does maintain a maximum account value. Accounts opened after April 15, 2024 may not have a balance higher than $250,000 for individual accounts or $500,000 for joint accounts. These limits include interest that has been paid to the account.

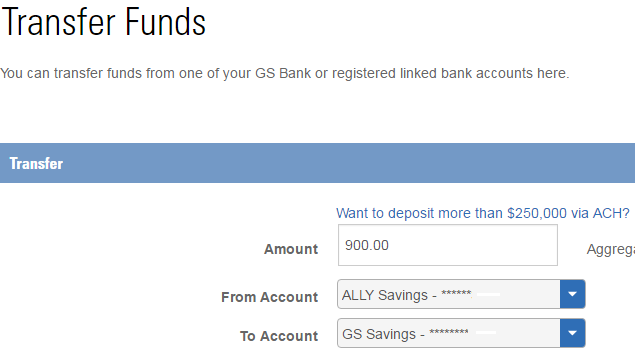

Deposits can be made by wire, ACH, and check. The check has to be mailed in via snail mail. Unfortunately, at this time the bank does not have a mobile app, so mobile check deposit is not an option. Withdrawals can be made by wire or ACH.

Certificates of Deposit

The bank also offers a selection of competitive CD's. These fixed-income products have terms from 6 months to 6 years. There is a $500 minimum to open a CD account. The same deposit limits for savings accounts also apply to CD's. Goldman Sachs has a 10-day rate guarantee for its CD products. Under this policy, customers can get a higher rate if the rate happens to increase within 10 days of opening a CD.

There are some significant penalties for closing a CD early. CD's with terms under 12 months are charged 3 months of interest. A CD with a term of 5 years or less is charged 270 days of interest. And a CD with a term greater than 5 years is charged 1 year of interest.

A six month CD currently has an APY of 0.70%, a 2 year product earns 1.10%, and a 6 year deposit earns 2.00%. Interest earned on a CD can be deposited into the CD, into a GS savings account, or an external bank account.

A Certificate of Deposit Calculator on the GS website displays how much a CD earns in interest based on the time to maturity and the amount of capital initially deposited. The calculator also compares the CD's interest rate to what other banks are offering.

Customer Service

An automated phone system is available 24 hours a day, 7 days a week. A living, breathing representative can be reached on a weekday from 7 am to 11 pm, CST. There is also a messaging system after logging into the website. Customers can e-mail the bank using this convenient feature.

A helpful FAQ with many questions covering several topics is also available on the website. This list will answer many questions that customers may have.

Comparison

Compared to other banks, Goldman Sachs's 1.05% savings account is very competitive. For example, EverBank's savings account has an APY of 1.60% for six months,

which then drops to 1.11% for another six months. After one year, the rate is 0.61%. EverBank has a minimum deposit of $1,500. Synchrony Bank has an on-going

rate of 1.05%, Ally Bank is at 1.00%,

Capital One 360 pays 0.75%, and State Farm Bank is much lower at just 0.10%.

Goldman Sachs Bank is a new player in the industry, so perhaps the company can be forgiven for not having a mobile app, yet. The lack of an app means there is no mobile check deposit. Other banks, such as Ally and Schwab Bank, offer mobile check deposit with their apps.

Savers who want a debit card and checks can open an Ally money market deposit account. However, it pays a lower 0.85%. Sallie Mae offers a money market account with checks. It pays 1.05%

Recap

As a new entrant into the world of retail banking, Goldman Sachs has brought a lot to the table, but has a few flaws that need to be improved. Main Street investors who want to be a customer of the famous company now have their opportunity.

|

|