|

Lending Club Accounts Review

Lending Club accounts review 2024: fees, APR/APY interest rates/high yields. New client promotions, service, cons.

|

Picking Investments at Lending Club

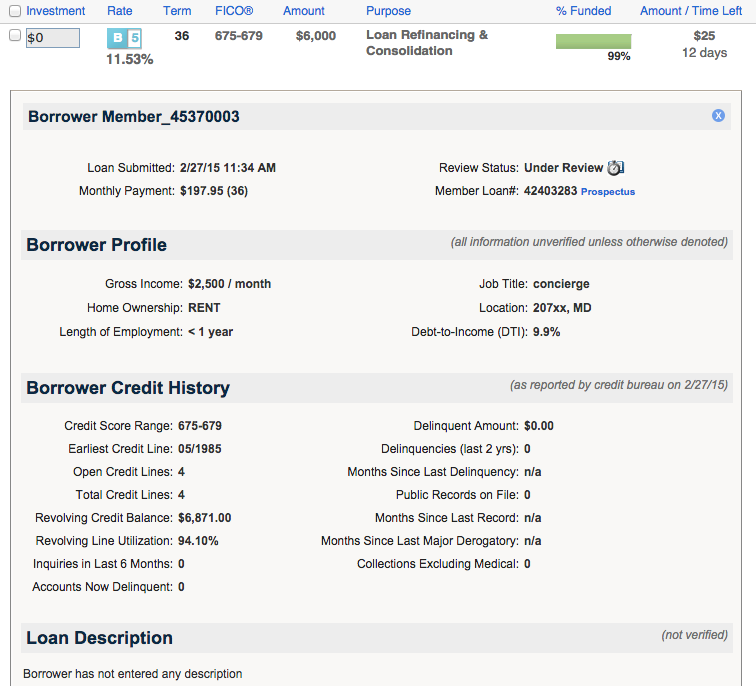

Lending Club offers users a huge amount of autonomy when it comes to picking investments. When a user clicks the “Brows Loans” tab they are brought to a list of thousands of loans of varying grades. Lending Club makes the initial sorting fairly easy by assigning a letter grade to each loan. This can make at-a-glance investing pretty simple, but users would be well advised to look into their loans closely.

As mentioned above, Lending Club offers an overwhelming amount of information for the new user. Manual investors should sift through all of the provided information, even though it can be (and probably is) intimidating at first. The reason for this is because Lending Club makes it easy to paint a picture of each individual borrower. If they decide to invest, investors can purchase loans in increments of $25 “notes”.

For example: in the image above someone working as a concierge and is looking for a three year $6,000 loan for refinancing or debt consolidation. They make roughly $30,000 per year, live in Maryland, rent a home, have a credit score of around 675, and have 4 credit cards with a revolving balance of $6,871. A prospective investor would have to decide if they think an 11.53% interest rate, or “return”, is worth the risk of the borrower defaulting.

It should be mentioned that selling notes on Lending Club before the loan’s maturation is a little difficult. If, for whatever reason, an investor wants to get rid of a note (or notes) they purchased in the past, they will have to sell them on the secondary market. This means they have to try and sell it to an interested investor. Lending facilitates this, and makes it somewhat easy. This is the only way certain individuals, like people in Pennsylvania, can invest in notes.

Peer-to-peer investing is a somewhat risky investment strategy. Investors will have to be mindful of the fact that loans can be, and sometimes are, defaulted on. This isn’t a concern for those with a well-diversified investing strategy, but it should be kept in mind.

Lending Club Fees

Lending Club fees are at the industry average level: the firm is charging a flat 1% fee on top of all of the interest investors receive. The fees will jump up to 18% if the loan is

more than 16 days past due.

Summary

In summary, Lending Club is a great option for people looking to get into peer-to-peer lending. Lending Club’s account signup process is one of the best across all financial institutions. On top of that, their entire website layout offers one of the best user experiences out there. Their product is very clean, polished, and easy to navigate; making it perfect for new and seasoned investors alike.

Peer-to-peer investing is a relatively new investment option. Lending Club makes this very interesting and profitable

investment option very approachable for the casual investor. We recommend trying it with a small amount to see if

it's a right opportunity for you.

|

|