Discover Money Market Review

Discover is a well-known company that provides a variety of financial services, ranging from bank accounts to CDs to IRAs. Discover is best known for the credit card

business they started in the 1980s. Since then, Discover has been slowly expanding the types of financial accounts they offer. This article will focus on Discover’s

relatively new money market account offering while giving brief summaries of some other options. What is a money market account? What’s the deal with Discover’s money

market account? Keep reading to find out.

What is a Money Market Account?

Before launching in to a review of Discover’s money market account, it would be beneficial to have an understanding of what, exactly, a money market account is.

A money market account is most similar to a traditional savings account, but with a few differences. The main, and best known, difference is that money market accounts typically have a better interest rate when compared to traditional savings accounts. The (usually) higher interest rate is because money market accounts track the prevailing rate on the “money markets”. Vanguard’s money market fund has the ticker symbol VMMXX, if readers are interested in seeing the current rate. The rates for money market savings accounts are generally lower than those in the mutual funds because the savings accounts carry no risk. This higher rate comes at a tradeoff however, as money market accounts typically have higher minimum balance requirements than savings accounts.

On average, money market accounts offer a 0.04% higher interest rate when compared to a savings account. While a higher interest rate is always welcome, the average minimum balance is a whopping $8,000 higher for money market accounts.

Account holders are still able to deposit and withdrawal money as they would in a traditional savings account. Another similarity between savings and money market accounts is that they are both insured by the FDIC (Federal Insurance Deposit Corporation).

Opening A Money Market Account With Discover

Opening a money market account at Discover is extremely easy. As seen in the picture above, a prospective customer only needs to provide four items: a home address, taxpayer identification, contact information, and bank routing and account numbers. This is all done through a intuitive online enrolment process. Discover makes this process even simpler for existing customers, who have the option to link an existing account and prepopulate a lot of the information.

There are very few restrictions to open a Discover Money Market account. The two major restrictions are that an account holder must be at least eighteen years old and maintain a balance of at least $2,500 in the account.

Website Layout

Discover’s website has improved in leaps and bounds within the last few years. The newest iteration is very modern and user friendly. The main account page shows users all of the information they’d want to know on a frequent basis; including the account balance, interest earned, recent transactions, and prevailing interest rate.

Navigating away from the main page is a breeze, too. Discover has very straightforward and simple to use toolbars at the top of every page. This is especially refreshing because many online financial institutions have somewhat convoluted navigation bars that are a hassle for new users. These bars allow users to view messages, update account options, view other linked accounts (if they have any), and get more info on recent statements.

On top of this fantastic website, Discover also offers quite a few other features that will be gone over in the next section.

Account Offerings

Discover offers many different features for their account holders. One of the most useful is their broad ATM network. Discover has partnered with not one, but two, major ATM networks, allowing account holders to access over 60,000 ATMs nation wide for free. This is a wonderful perk and it is likely to be used by almost every account holder.

Another set of unique features offered by the team at Discover is their calculators. These calculators help users figure out interest rates, how much the user should save to reach certain goals, and more. Yet another added perk is that Discover Bank earned Bankrate.com’s 5 star “Safe and Sound” rating for financial security and stability

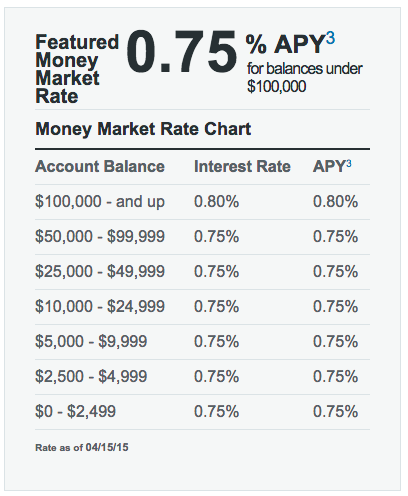

Rates (pictured to the right) are, unfortunately, where Discover’s money market account falls behind the rest of the pack. With many online banks offering no-minimum savings accounts with .90% to 1.05% interest rates, it’s hard to see why someone would pick this over others. Discover’s own online savings account currently offers a .90% interest rate.

Discover Money Market Review Summary

Overall, Discover’s online money market account offers a ton of great features at the cost of a competitive interest rate. They have a fantastic ATM network,

allowing account holders to withdrawal money quickly and easily. Account owners can rest easy knowing that Discover Bank is a highly rated and very secure company,

insured by the FDIC. Discover’s updated and modern website gives account holders an easy way to check up on their account and watch their money grow, day or night.

Unfortunately, the “watch their money grow” part is the problem. The rate offered by their money market account is a very unappealing 0.75%. Discover’s own online

savings account currently has a fairly competitive 1.05% interest rate.

It’s hard to recommend that anyone open a Discover money market account with the low rates and required $2,500 minimum balance when there are better options on

the market. If someone really wants an account with Discover, they can open a superior Discover online savings account just as easily.

Bank of America Money Market Review

Bank of America offers Personal and Platinum Money Market Accounts that can be opened with a minimum deposit of $25. The Personal Money Market Accounts provide customers with interest rates that are significantly higher than standard savings accounts and that increase with the account’s balance. The Platinum Money Market Accounts share a similar structure, but reward customers, who have an active personal checking account and maintain a minimum of $50,000 across eligible accounts, with even higher interest rates.

Both account types are administered similarly, with the exception of their maintenance fees, interest rates, and the exclusive features that are provided to solely to Platinum customers.

The following examines the important aspects of Bank of America’s Money Market Accounts.

Features

Both of Bank of America’s Money Market Account options provide basic features that include: the convenience of online and mobile banking; overdraft protection for adjoined checking accounts; and Keep the Change enrollment, in which Bank of America rounds up debit card transactions to the next dollar, then deposits the rounded up difference into the accountholder’s money market account.

Platinum Money Market Accountholders have access to additional perks like exclusive rates for savings accounts, Individual Retirement Accounts, and CDs, as well as their own special customer service group.

BOA MMA Annual Percentage Yield

Annual Percentage Yields (APYs) vary by geographic location and type of Money Market Account. At Bank of America, the APY is on a tiered system, which directly corresponds to the account balance. Prospective consumers can visit Bank of America’s website and plug in their state to find out an exact range. For a quick comparison, Bank of America’s rates range from 0.03% to 0.07% for a Personal Money Market Account and 0.05% to 0.12% for a Platinum Money Market Account in the state of Maryland. These APYs are: better then those of Wells Fargo which range from 0.03% to 0.05%; comparable to those of M&T Bank which range from 0.04% to 0.13%; and subpar to those at PNC, where the range is between 0.05% and 0.16%.

Bank of America and each of the other referenced financial institutions have disclaimers on their websites, stating that the Annual Percentage Yields are subject to change at any time.

BOFA MMA Monthly Maintenance Fees

Bank of America charges a $12 monthly maintenance fee on money market accounts, although the maintenance fee can be waived for accountholders who maintain a $2,500 minimum daily balance or link their account to a Bank of America Interest Checking Account. When compared to other financial institutions, Bank of America’s monthly maintenance fee and waiver requirements are fairly reasonable. For the sake of comparison: M&T Bank charges a $15 monthly maintenance fee and requires a minimum daily balance of $2,500 to waive it; Wells Fargo charges a $10 monthly maintenance fee and requires a minimum daily balance of $3,500 to waive it; and PNC charges a $10 monthly maintenance fee and requires a minimum daily balance of $1,000 in order to waive it.

Transaction Limitations

Because of federal guidelines and Bank of America’s deposit agreement, money market accountholders are limited in the number of withdrawals and transfers they can make from their money market account each month. The maximum limit of monthly withdrawals is 6 only 3 of those withdrawals can be made by check or debit card, as applicable.

Customer Service

For the average accountholder, Bank of America’s customer service has both pros and cons. Customers who live in metropolitan or suburban areas are likely to experience long, frustrating waits when visiting a branch. When contacting Customer Service by phone, the experience is hit or miss. At times, there is little-to-no-wait to speak with a representative; however, other times callers can expect to wait between 5 to 10 minutes to get a representative on the phone.

The customer service representatives are usually pleasant and helpful. They seem to spend as much time as needed to provide information and answer questions. However, one can’t help but notice they also try to upsell and cross-sell products. For instance, it seems to be standard protocol for them to throw in a plug about Bank of America credit cards, when consumers call in for information on other accounts.

Customers, who qualify for Bank of America’s Platinum Privileges program, have access to a more individualized, relationship-driven customer service experience through a special team of representatives, solely dedicated to assisting Platinum level customers.

BOFA MMA Review Summary

Bank of America is a practical option for anyone looking to open a Money Market Account. Overall, they’re comparable to Wells Fargo and M&T Bank, with respect to their maintenance fee requirements and Annual Percentage Yields. However, PNC seems to be an attractive alternative because of their lower maintenance fees, their lower balance requirements to qualify for account fee waivers, and their higher Annual Percentage Yield rates.

BBVA Compass ClearChoice Money Market Review

The Spanish banking giant BBVA has a subsidiary in the U.S. called BBVA Compass. This bank is FDIC insured and offers a wide selection of banking products, including a money market account. Let's check out the money market account and see how it compares to some of its rivals.

Opening an Account

Opening the money market account over the Internet is quick and easy. The on-line form is simple to use. It does ask for a government-created ID, such as a passport, and a Social Security Number. The form can be automatically filled if the applicant already has a BBVA Compass account. This makes the application process quick and trouble-free. The bank does perform a hard inquiry on TransUnion during the application process.

The account has a $25 minimum to open. The deposit can be sent by check, or made electronically using ACH. BBVA Compass also permits the money market account to be funded with a debit or credit card.

General account forms have to be signed electronically during the account opening process. The account is available immediately after completing the application. New customers of the bank must make 3 security questions. These will be used later for log-in purposes.

If the money market account is funded using an external bank account, the password and User ID of the external account must be entered. Customers can also add a second BBVA bank account to the account login, but it takes the bank 1 or 2 business days to complete the process, a slight irritation.

BBVA Compass ClearChoice Money Market Account

There is a monthly charge of $15 for the money market account. This fee can be waived by maintaining an account balance of at least $10,000 or setting up an automatic monthly transfer of at least $25 from a BBVA Compass checking account. BBVA Compass is FDIC insured, so the money market account is guaranteed up to $250,000.

There are some nice features the account has. For example, paper statements are available at no charge. Bill pay can be added to the account at no cost.

The account earns interest. Currently, the standard rate is 0.05% for balances under $10,000, while accounts above $5,000,000 earn 0.25%. However, new accounts can earn a higher rate with a promotion (see below).

Checks and a debit card can be added to the account. However, checks must be ordered and paid for by the customer. There is no charge to use the debit card at a BBVA Compass ATM. There is a $2.50 charge for all other ATM's. Furthermore, a fee of $25 is also imposed if the account is closed in under 180 days.

Account Management Tools

BBVA Compass's website has several useful account tools and is easy to learn. Users can nickname various on-line accounts, create overdraft protection, order copies of cleared checks or statements, and a lot more. The bank provides its customers with popmoney, a person-to-person payment system. It's available after logging into the website.

Alerts are also available. They can be sent for a variety of triggers, such as when a withdraw exceeds a pre-defined amount, an insufficient balance is reached, or sensitive activity occurs. Alerts can be set up for certain accounts but not others. They can be sent via e-mail or text message.

Beyond the website, savers can also bank with a smartphone or tablet. The bank's apps work on Android, Apple, and mobile web. Many helpful features are on the app, including mobile check deposit, a rewards center, and funds transfer.

Customer Service

The bank has a handy messaging system on the website. Using this feature, customers can e-mail a BBVA Compass associate day or night. The bank also provides a handy FAQ on its site. It can be opened by clicking on the question icon in the upper-right part of the web page.

Customers who want to speak to a human being can call 1-877-737-7727 on weekdays from 8 am to 7 pm (CST). Live reps are also available on Saturday from 9 am to 4 pm. An automated phone system can be reached 24 hours a day, 7 days a week at 1-800-266-7277.

BBVA Compass ClearChoice Money Market Promotions

New BBVA Compass ClearChoice Money Market accounts opened with at least $10,000 will receive a very good 0.65% APY for one year. To earn this rate, the account balance must be below $5,000,000.

Recap

BBVA Compass offers good banking features for both long-term savers and short-term cash needs. Customers who want free checks or need a larger ATM network will find better options with a different bank.

|